Find your prefect pair,

from 1,000s of Styles

The world's largest therapy

service. 100% online.

Health with Heart

The 1st Plant-Based

Recovery Drink

Recover stronger.

Live Better.

How it works

Go beyond sick care: Use your pre-tax dollars to invest in fitness, nutrition, and cutting-edge tools that support your everyday well-being.

How HSA/FSA Funds Are Traditionally Used

HSAs and FSAs allow you to use pre-tax dollars for healthcare, but they generally cover only traditional medical costs like co-pays and prescriptions—leaving out many important wellness-related expenses.

Expanded Access to Smarter Health Spending with Sika

Sika makes it easy to use your HSA/FSA funds for proactive health essentials—like fitness, nutrition, and cutting-edge wellness tech. With a Letter of Medical Necessity, you can access these powerful solutions and save up to 30% using pre-tax dollars.

Popular Categories

Mom & Baby

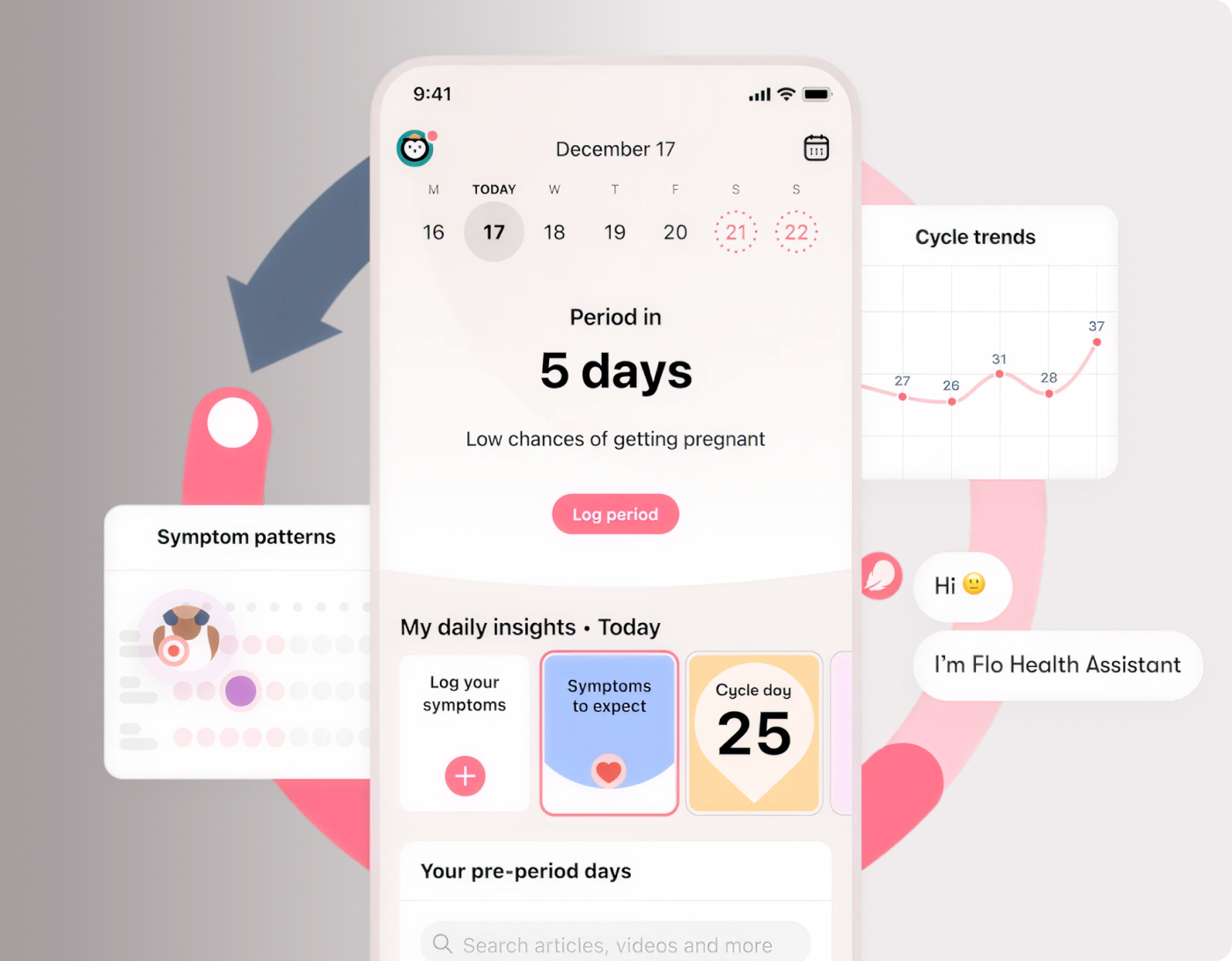

Women's Health

Skincare

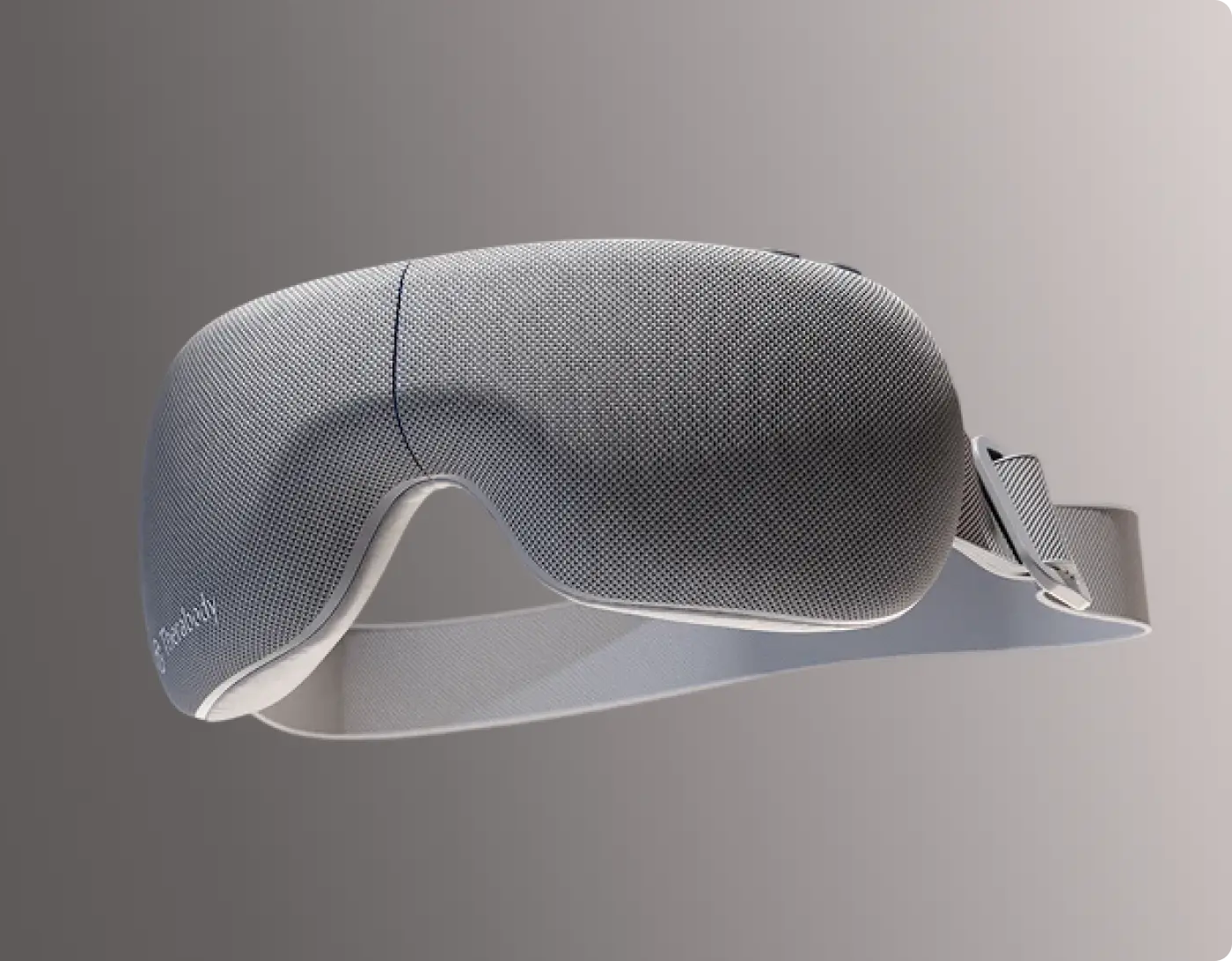

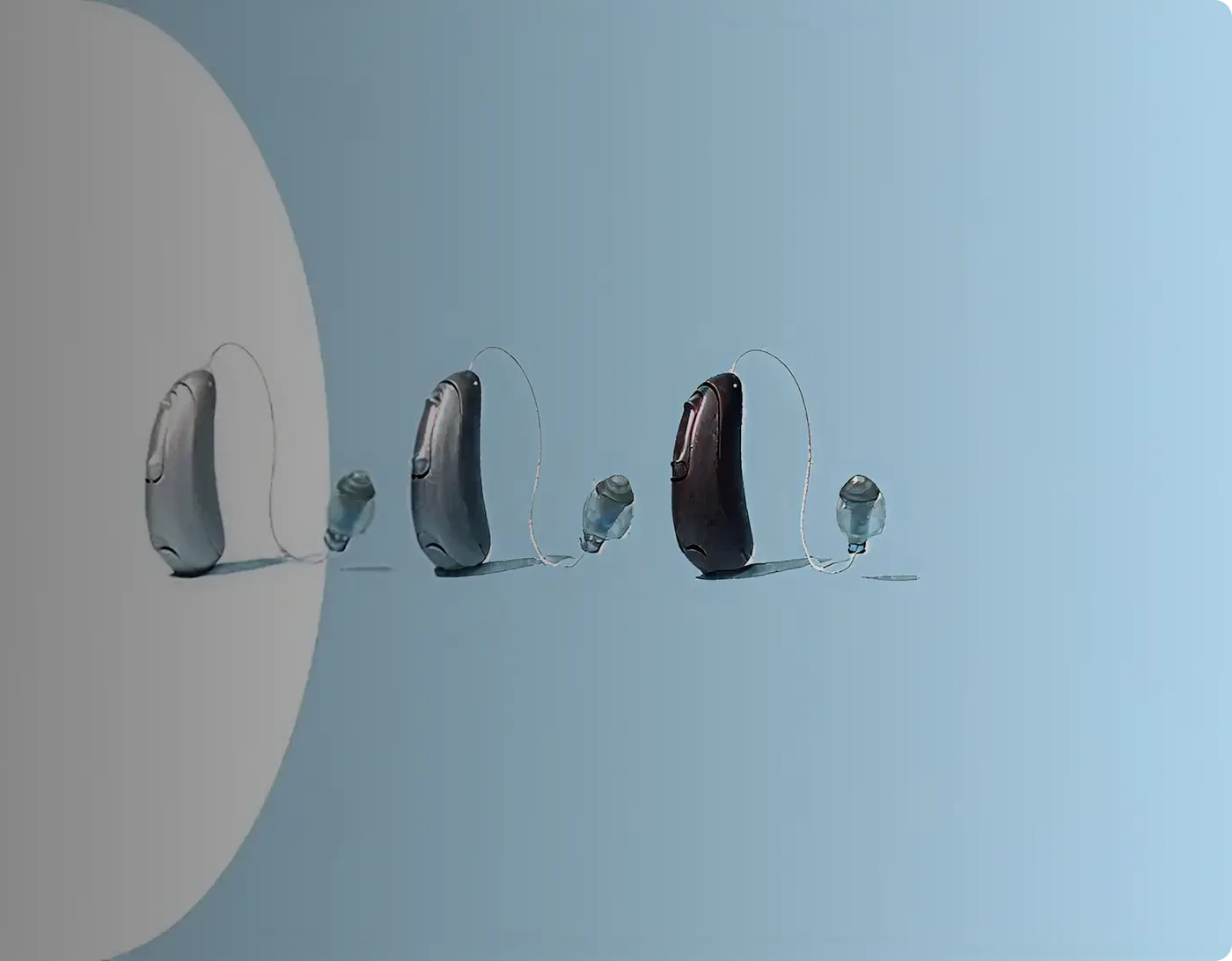

Eyes & Ears

Personal Care

Pain Relief

Fitness & Recovery

Sleep

Vitamins & Supplements

Tuck and Bundle

Tuck and Bundle offers premium, lightweight baby wrap carriers made from breathable...

Woddle Baby

At Woddle™, we know parenting can be really hard and we are...

Best Sellers

-

The Plug Drink

Vendor:Plug DrinkRegular price From $14.99 USDRegular priceUnit price / per$0.00 USDSale price From $14.99 USD -

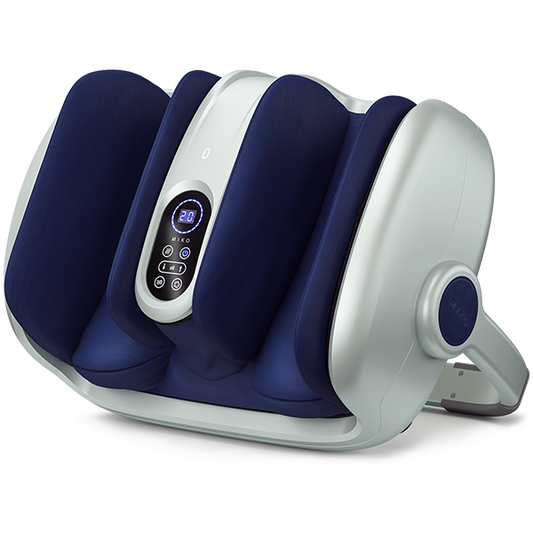

Air-C Compression Massager

Vendor:ReAthleteRegular price $149.99 USDRegular priceUnit price / per$299.99 USDSale price $149.99 USDSale -

The Plug Drink 24 pack

Vendor:Plug DrinkRegular price $110.00 USDRegular priceUnit price / per$144.00 USDSale price $110.00 USDSale -

Leg Compression Sleeves

Vendor:RECO Technology LLCRegular price $549.00 USDRegular priceUnit price / per -

Soothing Hydration Cream

Vendor:Marin SkincareRegular price From $19.99 USDRegular priceUnit price / per

Best Deal of the Week

-

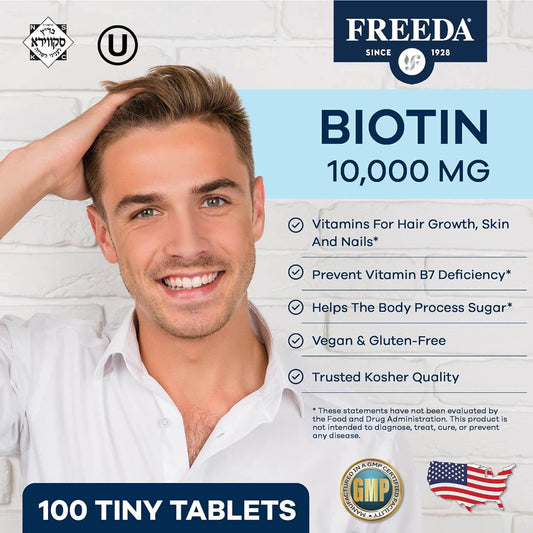

Biotin 10 mg

Vendor:Freeda HealthRegular price $25.00 USDRegular priceUnit price / per$25.00 USDSale price $25.00 USD -

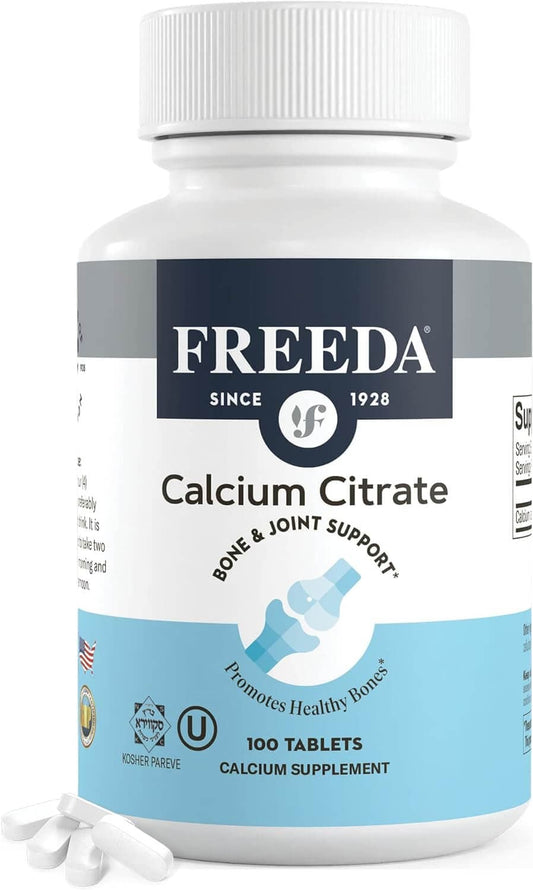

Calcium Citrate 250 mg

Vendor:Freeda HealthRegular price From $17.00 USDRegular priceUnit price / per$17.00 USDSale price From $17.00 USD -

Soothing Hydration Cream

Vendor:Marin SkincareRegular price From $19.99 USDRegular priceUnit price / per

DEEP4s

This percussion massage gun featuring multiple speed settings and interchangeable massage heads. It offers quiet operation, a long-lasting battery.

Ultrahuman Ring AIR

World’s most comfortable sleep tracker. Accurately tracks sleep, HRV, temperature, and movement with daily actionable health insights.

Featured Products

-

Soothing Hydration Cream

Vendor:Marin SkincareRegular price From $19.99 USDRegular priceUnit price / per -

Biotin 10 mg

Vendor:Freeda HealthRegular price $25.00 USDRegular priceUnit price / per$25.00 USDSale price $25.00 USD -

Chelated Zinc 30 mg (Albion TRAACS™ Bisglycinate)

Vendor:Freeda HealthRegular price From $19.00 USDRegular priceUnit price / per$19.00 USDSale price From $19.00 USD -

Mini Go Red Light Therapy

Vendor:Happy Sol WellnessRegular price $109.99 USDRegular priceUnit price / per

Frequently Asked Questions

What is an HSA or FSA?

A Health Savings Account (HSA) is a pre-tax account that lets you set aside money for qualified healthcare expenses. Typically, you can sign up for an HSA when you sign up for a High Deductible Health Plan. These accounts are individually owned so the funds roll over each year and you can take them if you leave your job.

A Flexible Spending Arrangement (FSA) is an employer-offered benefit plan that lets you set aside money for qualified healthcare expenses. You can sign up for an FSA if your employer offers this option. It’s important to remember that FSA funds do not roll over at the end of the year (unless your employer allows it) and they immediately are returned to your employer if you leave your job. Spending with your pre-tax HSA/FSA funds helps you to save 30% to 50% on qualified health expenses. And we’re here to help you maximize your savings.

Sika makes it easy to discover and spend on qualified items at your favorite brands. Just look for Sika at checkout and start spending smarter today.

Are the merchants on this platform vetted?

Yes. All merchants on our platform go through a basic vetting process before they are approved to sell. This includes verifying business information, assessing product quality, and ensuring compliance with marketplace guidelines. We aim to ensure that only reputable and trustworthy sellers are listed. However, please note that all merchants operate independently. Sika provides the platform but is not the seller of record for products purchased on the site.

Who am I buying from at checkout?

When you place an order through our platform, your purchase is made directly from the third-party merchant offering the product. Sika acts as a facilitator to provide a smooth checkout experience but is not the seller of record. Your order, shipping and any post-purchase support are managed by the merchant.

Is my purchase eligible for HSA/FSA reimbursement?

Some items on our platform may be eligible for HSA (Health Savings Account) or FSA (Flexible Spending Account) reimbursement. We display eligibility information for your convenience, but it is your responsibility to confirm with your HSA/FSA provider whether a particular item qualifies for reimbursement. Eligibility rules may vary depending on your plan.

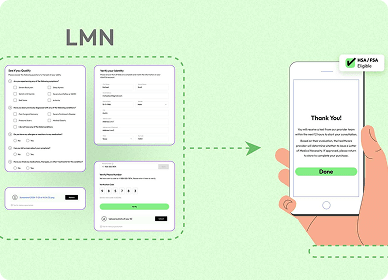

How do I know which items are qualified to purchase with HSA/FSA funds?

Sika tags every item that is eligible for HSA/FSA purchase. Each product listing clearly indicates whether the item is always eligible or eligible with a Letter of Medical Necessity (LMN). This makes it easy for you to identify which items can be purchased with your HSA/FSA funds.

What if I don’t have my HSA or FSA card with me right now?

Even if you don’t have your HSA/FSA card handy, you can still choose the Sika payment method and check out with your credit/debit card. We will then follow up with an itemized receipt that you can submit to your HSA/FSA administrator. Sika's receipts are in a form accepted by HSA/FSA administrators to ensure that you can reimburse yourself worry-free with your tax-free dollars even when you don’t have your card on hand.

What if I’m running low on my HSA or FSA funds and don’t know my remaining balance?

Your balance is too low to cover your payment, we’ll tell you exactly how much is remaining so that you can spend down to the very last penny. For the remaining amount, just use your non-HSA/FSA debit or credit card and we’ll handle the rest. (Note that some plan administrators do not make the remaining balance eligible to display to customers, in which case you should contact your administrator directly.)

How does Sika handle returns, refunds, or cancellations?

We aim to make your shopping experience as smooth as possible. Here’s how support is typically handled:

Returns & Refunds: Return and refund policies may vary by merchant and are usually listed on the product or store page. If you’d like to request a return or refund, please refer to the relevant policy and reach out accordingly.

Cancellations: If your order hasn’t been shipped yet, cancellation may be possible. Please check with the merchant as soon as possible.

Support: For any issues with your order, we’re here to help! Please contact support@sikahealth.com and we’ll either assist you directly or connect you with the right merchant.

Can I use Sika to spend my HRA?

Unlike HSAs and FSAs, HRAs (or Health Reimbursement Accounts) are specifically funded and owned by your employer. As a result, these accounts might have more strict requirements on how funds can be spent. If you are looking to spend with your HRA funds, it's best to check with your plan administrator or employer first.